Hundreds of thousands of people are struggling to make ends meet between paychecks. You're not alone. An estimated 12 million Americans take out payday loans each year to cover short-term costs. And while payday loans come with notoriously high-interest rates, they provide a convenient lifeline when unexpected expenses arise. As an affiliate marketer, you can earn commissions by connecting borrowers to lenders offering the best loan terms.

This article will explore five top-tier payday loan affiliate networks that offer high conversion rates, reliable payments, and weekly payouts of up to $350 per lead. Whether you're an affiliate marketing veteran or just starting, these programs provide the tools and support needed to maximize your earnings.

So read on to learn which payday loan affiliate networks deliver the highest returns in 2024!

What are Payday Loan Affiliate Networks?

Payday loan affiliate networks connect borrowers seeking short-term loans with lenders who provide them. As an affiliate marketer, you can join these networks to promote payday loan offers on your website or other platforms. When visitors you refer go on to complete a loan application or get approved for a loan, you earn a commission.

Payday loan affiliate networks handle connecting borrowers with lenders and tracking conversions so affiliates can focus on generating traffic and leads. Top programs offer high commission rates up to $250 per lead as well as marketing tools and support to boost earnings. Joining a reputable payday loan affiliate network allows marketers to tap into consumer demand for these loans and generate significant income.

Payday Loan Affiliate Networks Compared to Other Affiliate Networks

Payday loan affiliate networks have some key differences from other affiliate programs that make them attractive to marketers. First, payday loan offers tend to pay much higher commissions – often $100 or more per lead, compared to a couple of dollars earned from many banner ad programs. Payday loan networks also provide better tracking and optimization tools to improve conversions. And they offer dedicated support, including customized creatives and landing pages.

However, payday loan marketing also comes with more legal and ethical considerations due to the high fees and interest rates charged to borrowers. Affiliates must ensure the lenders they work with follow regulations and industry best practices. This additional compliance requirement sets payday loan affiliate programs apart from standard affiliate marketing. But for those willing to do their due diligence, payday loan networks provide an opportunity to earn substantial recurring commissions in a growing financial services market.

| Type of Affiliate Program | Typical Commission per Lead | Compliance Requirements |

|---|---|---|

| Payday Loan Networks | $100+ | High |

| Banner Ad Networks | $1-5 | Low |

Best Payday Loan Affiliate Networks

| Payday Affiliate Networks | Commission Offered |

|---|---|

| PDL-Profit | Commission ranging from $2 to $400 per approved loan |

| Fintelconnect | Got banks, credit unions and fintech companies as advertisers |

| LeadNetwork | Offers weekly payouts of up to $250 per lead |

| Lead Market | Max commission of $250 per lead |

| Round Sky | Over 50 different offers |

| Profitner | Up to $230 per lead |

1. PDL-Profit

With a history of over four years, this international CPA network has built a reputation for ease of use and a pleasant working experience for affiliates. They offer instant payouts upon request, which is quite a standout feature in an industry where advertisers often delay payments. Their portfolio boasts over 300 financial offers, including payday loans, banks, credit cards, and insurance, catering to a global network of over 2000 active affiliates.

What sets PDL-Profit apart is its commitment to providing a suite of technical tools designed to boost conversion rates and streamline traffic management. These include a Smartlink, API, FB Integration, SMS Sender, Showcase builder, and a Telegram Bot, among others. They also offer a generous allowance of 4000 free messages per month to support affiliate marketing efforts.

Affiliates have the flexibility of receiving payments through various channels such as PayPal, Payoneer, Tether, Webmoney, Visa, and Mastercard, ensuring convenience across different geographies. With 24/7 support from top-notch in-house specialists, PDL-Profit positions itself as a stable and secure network that prioritizes long-term cooperation and mutual profitability.

PDL-Profit Key Features

- Daily payouts: PDL-Profit provides an opportunity for affiliates who have passed the traffic quality assessment to pay profits on a daily basis

- Higher rates: More than 80% of PDL-Profit offers higher rates than competitors.

- Many technical tools: With PDL-Profit's tools, you will increase your conversion rate and earnings. Smartlink, SMS Sender, and API can increase your CR by up to 10%. PDL-Profit also provides a showcase builder where you can create a ready-made website for payday loan traffic.

- Bonuses for new affiliates: Get 5000 free posts to start and 1000 every week after that. Also in the first month, you will have an increased payout – +5% to profile on geo: US, MX, PL, RO, ES, VN, PH.

- Referral system: with PDL-Profit you can earn from your referrals. Place a referral link on your resource and get profit from affiliates who registered through your link.

- Big Data: PDL-Profit's in-house solution has a wealth of information about borrowers, which helps the system better rank offers in showcases.

- Flexibility and Openness: PDL-Profit adds any offerer at the affiliate's request.

2. Fintelconnect

Fintelconnect is a standout affiliate network in the payday loan and broader financial sector, offering a unique blend of support, tools, and competitive payouts to its affiliates. Specializing in the financial industry, Fintelconnect connects affiliates with high-quality financial brands, including banks, fintech companies, and credit unions, facilitating lucrative partnerships.

The network is renowned for its emphasis on ensuring affiliates have access to top-tier financial products and services to promote, alongside robust tracking and reporting tools for optimizing performance. Fintelconnect's commitment to providing exceptional support is evident through its provision of dedicated affiliate managers and a platform designed for financial services, ensuring affiliates can maximize their earnings while maintaining compliance and brand integrity.

Fintelconnect Key Features

- Specialized in the Financial Industry: Tailored affiliate opportunities in banking, loans, and fintech.

- Competitive Payouts: Offers high-value consumer offers and competitive affiliate payouts.

- Exceptional Support: Dedicated affiliate managers and a responsive support team.

- Comprehensive Tools: Access to real-time analytics and flexible APIs for data-driven optimization.

- Exclusive Opportunities: Partnerships with top financial brands, including exclusive offers.

- Timely Payments: Reliability in payouts, ensuring affiliates are compensated on time.

3. LeadNetwork

For affiliate marketers, LeadNetwork provides one of the top-paying pay-per-lead programs in the niche, offering weekly payouts of up to $250 per lead. Their proprietary lead optimization software ensures high conversion rates and maximizes earnings for publishers.

Dedicated account management, customizable promotions, and compliance training provide the support affiliates need to succeed. With expertise in monetizing high-demand financial services leads, LeadNetwork delivers substantial recurring income in this lucrative vertical.

LeadNetwork Key Features

- High Earnings: LeadNetwork offers some of the industry's highest payouts per lead, with maximum cost-per-lead up to $230.

- Advanced Tools: Affiliates have access to a comprehensive suite of tools, including real-time statistics, analytics, and marketing tools like banner ads and customizable email templates.

- Weekly Payments: The network provides weekly payouts through various platforms such as PayPal, wire transfer, and others, with a minimum payout of $100.

- Dedicated Support: LeadNetwork provides unparalleled support to help affiliates succeed, including personal account managers for custom partnerships.

- High Conversion Rates: The network boasts high conversion rates due to its advanced tools and proprietary consumer-lender connecting technology.

- Global Traffic Acceptance: LeadNetwork accepts traffic sources from around the world, offering affiliates a broad scope for their campaigns.

4. Lead Market

Lead Market is a prominent affiliate network in the payday loan industry, offering a platform where lenders and publishers can connect. With over a decade of experience, Lead Market has established itself as an industry leader, paying out over $350 million in commissions since its inception in 2011.

The network's proprietary LeadBrain® software gives it a competitive edge, enabling efficient lead generation and management. Lead Market's affiliate program is popular due to its multiple payout structures, high-converting landing pages, and self-service online affiliate portal.

Lead Market Key Features

- Multi-tier Commissions: Affiliates can earn commissions on both the sales they generate and the sales made by their referrals.

- Multiple Payout Structures: Lead Market offers various payout structures, including revenue share or tier structure, providing flexibility for affiliates.

- High-Converting Landing Pages: The network provides high-converting landing pages to help affiliates attract and convert leads.

- Self-Service Online Affiliate Portal: Affiliates have access to a self-service online portal, making it easy to manage their activities.

- Weekly Payouts: Lead Market offers weekly payouts, ensuring affiliates receive their earnings promptly.

- Dedicated Support: The network has a team of dedicated professionals who provide continuous support to affiliates.

5. Round Sky Affiliate Network

Round Sky is one of the leading payday loan affiliate networks, connecting lenders with consumers looking for loans. Founded in 2006, Round Sky works with over 50 lenders and thousands of affiliates globally.

As an affiliate, you earn commissions by referring consumers to lenders that can fulfill their loan requests. Round Sky offers competitive rev share and CPA commission rates up to $250 per approved lead. Affiliates also get access to banners, text links, email creatives, and other marketing materials to promote offers.

Round Sky Key Features

- Lucrative commissions up to $250 per approved lead through CPA or revenue share models.

- Weekly and monthly payment options so you get paid quickly.

- User-friendly real-time reporting system to track your campaigns.

- Connect with a large network of over 50 lenders to match consumer loans.

- Complete marketing creative suite including banners, widgets, and text links provided.

- Flexible offers include payday loans, installment loans, and line of credit loans.

- Dedicated affiliate manager support and optimization insights.

6. Profitner

Profitner stands out in the competitive landscape of payday loan affiliate networks by offering a unique blend of technology, high commission rates, and a focus on maximizing profits for its affiliates. As a platform that goes beyond the traditional affiliate program, Profitner prides itself on sharing profits with active and talented partners. With a commitment to ensuring high conversion rates and timely payouts, Profitner has established itself as a go-to network for affiliates looking to capitalize on the lucrative payday loan market.

The network's smart system is designed to sell up to 90% of traffic, ensuring that affiliates can convert their efforts into profit efficiently. With a comprehensive database of lenders and a variety of traffic types supported, Profitner offers a robust solution for affiliates aiming to succeed in the U.S. loan industry.

Profitner Key Features

- High Commission Rates: Earn up to $230 per lead, one of the highest in the industry.

- Weekly Payouts: Reliable and timely payments to affiliates, enhancing cash flow.

- Smart Earning System: Increases profits by up to 34%, maximizing earnings.

- Conversion-Optimized Tools: Access to tested landing pages and JavaScript forms that boost conversion rates by over 30%.

- API Integration: Offers rapid data access for efficient campaign management.

- Exclusive Offers: Top affiliates receive brand-new offers, providing fresh revenue opportunities.

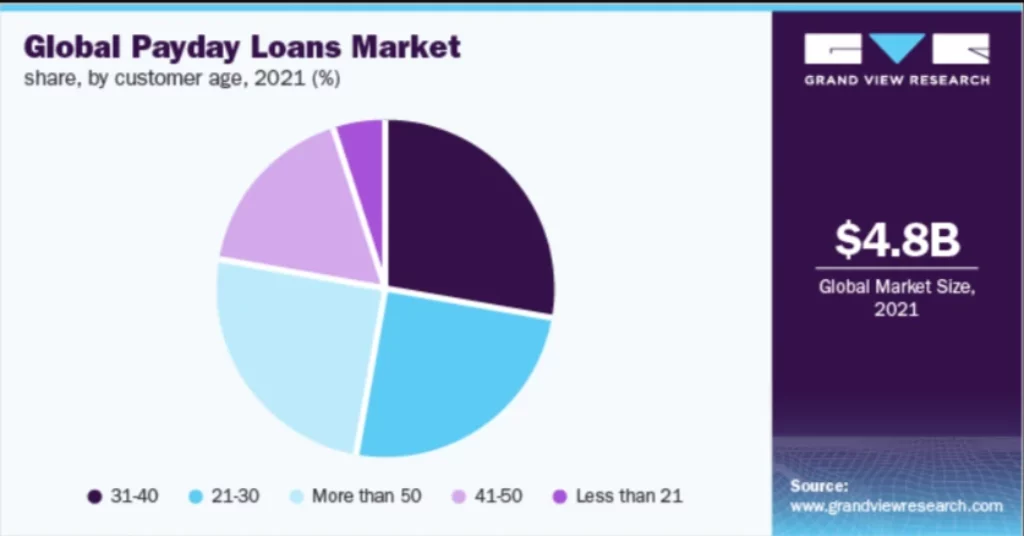

Insights on the Payday Loan Industry

The payday loan industry is a significant sector in the U.S. financial landscape, with an estimated 12 million Americans taking out these short-term, unsecured loans each year. These loans, typically ranging from $375 to $500, are often used to tide over consumers until their next paycheck. However, they come with high fees, translating to annual percentage rates (APRs) of 390% or more.

The industry thrives on extended indebtedness, with 75% of loans going to borrowers who take out 11 or more loans per year. Interestingly, the industry isn't price-competitive, with most lenders charging the maximum rates allowed by state laws.

The payday loan market is valued at over $20 billion, with around 15,600 payday lending stores across the U.S. Despite the growth of online lending, storefronts still hold a majority market share of 53.7%. Key players in the industry include CashNetUSA, SpeedyCash, TitleMax, Check Into Cash, and LendUp.

However, it's important to note that these loans can be financially destabilizing due to their high-interest rates and short repayment terms. Many borrowers struggle to repay, with 75-80% of loans taken out within two weeks of paying off a previous payday loan.

Despite these challenges, the industry is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2022 to 2030. This growth is driven by factors such as the increasing awareness of payday loans, especially among the younger generation, and the convenience offered by online banking.

FAQs Related to Payday Affiliate Networks and Programs

What are the commission rates in payday loan affiliate networks?

Commission rates vary, but some networks offer up to $230 or even $250 per lead, making them highly competitive.

How often do payday loan affiliate networks pay out?

Payout schedules can vary, but many networks offer weekly payouts, ensuring a steady cash flow for affiliates.

What are the requirements to become an affiliate in a payday loan network?

Requirements can vary, but generally, you need a platform (like a website or a blog) to promote the offers and comply with the network's guidelines.

How can I maximize my conversion rates in payday loan affiliate networks?

Utilizing the network's conversion-optimized tools, following best practices for your traffic type, and continuously testing and optimizing your campaigns can help maximize conversion rates.

What kind of support and resources do payday loan affiliate networks provide?

Networks often provide conversion-optimized tools, API integration for efficient campaign management, and dedicated affiliate managers for support.

More from AFFranking:

Wrapping Up on Payday Loan CPA Networks

So there you have it, folks – the inside scoop on some of the top payday loan affiliate networks making waves right now. As you can see, there are plenty of lucrative options to consider if you want to capitalize on this high-commission industry. Whether it’s Profitner with its profit-focused smart system, LeadNetwork and its sweet $250 per lead, or other tools optimized conversion tools, each network brings something unique to the table.

Of course, do your own due diligence before joining any program. But if you’re willing to put in the effort on promotion and optimization, a quality payday loan affiliate network could prove very rewarding indeed. Think hard about your strengths and business model, then pick a network that aligns well and helps you play to those strengths.

Do that and you’ll be laughing all the way to the bank. I’m rooting for you guys – now get out there and smash it as a payday affiliate!