What's the simplest way to guarantee a 10-30% (or even 50%) increase in ROI? Naturally, it's reducing expenses. The process of diligently searching and selecting resources for an affiliate is just as essential as finding the right offer and the optimal combination.

As usual, the issue of “trustworthiness” and “quality” of payment methods remains debatable, when the question of fees is more tangible, though not obvious. We have researched the market of cards for digital and affiliate marketing, and in this article, we will try to explain how choosing a payment instrument can help optimize ROI by 10-30% (or even up to 50%).

How to Increase ROI with PST.Net?

Experienced marketers know that a stable 30% ROI on large volumes is an excellent result. Let's illustrate how your ROI will increase if you simply choose the right payment option using an average result as an example.

ROI (Return on Investment) – is the profitability coefficient of your advertising campaign. It is calculated using the formula ((Income – Costs) / Costs) x 100%.

If we recall the ROI formula, it becomes evident that with a 30% ROI and a reduction in costs by just 5%, our profit increases by more than 20%. And if we optimize expenses by 10%, we can see a nearly one-and-a-half times increase in ROI.

| Without optimization | Optimizing costs by 5% | Optimizing costs by 10% | |

| Income | 130 | 130 | 130 |

| Costs | 100 | 95 | 90 |

| ROI | 30,00% | 36,84% | 44,44% |

In this article, we will explore what's new the world of virtual cards brought us in 2024 and how it directly affects ROI.

1. Fees

The potential for increasing ROI is directly tied to the size of VCC fees, which can range from 1-2% to 14% of your budget.

Here, we would like to highlight four main categories of commissions:

- Account/card top-up fees,

- The cost of the cards themselves

- Cashback, if available.

- Transaction fees (excluding international taxes, as this depends on each specific setup and affiliate strategy and can be mitigated if it's part of the strategy).

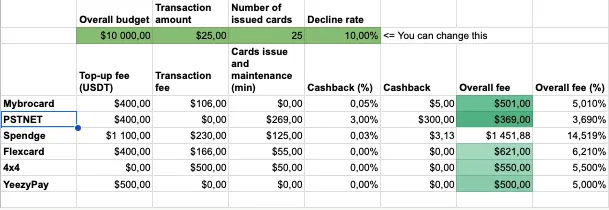

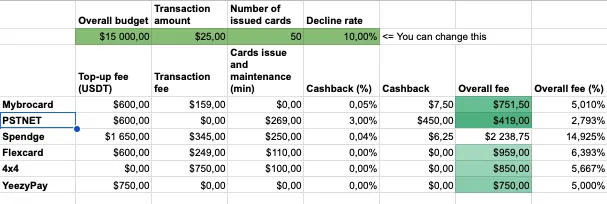

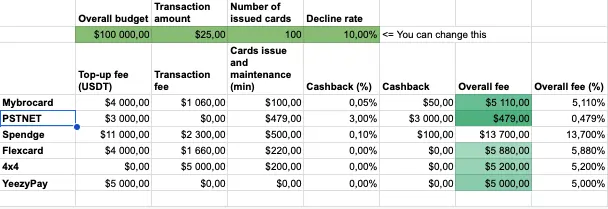

To calculate the benefits and fees, we will rely on this interactive calculator, which provides a clear view of the total commission amount under various variables. In the end, the best results for increasing ROI were demonstrated by PST.NET with their Private program, which has a total commission rate of 0.4%, compared to 5-13% for other services. Thus, later on we’ll provide more details about this one exactly.

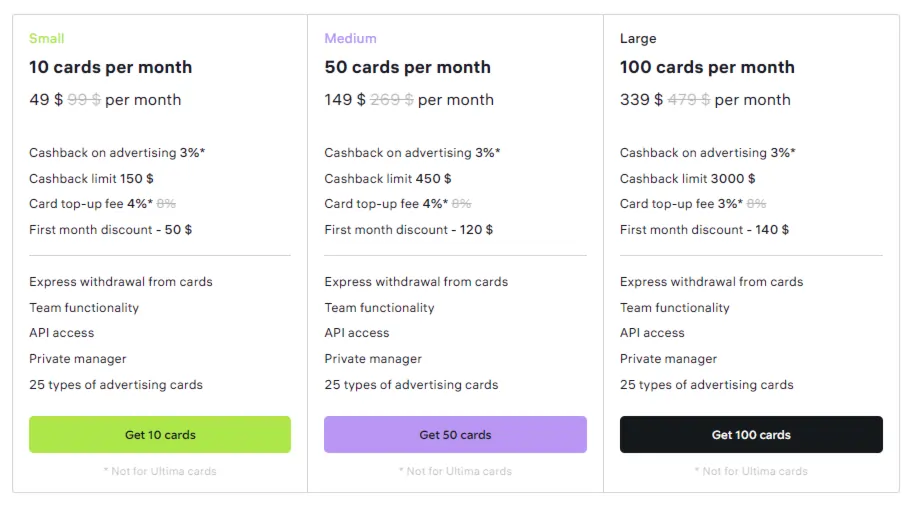

Private has transitioned to a subscription model and now offers a 3% cashback on advertising and a package of free cards (from 10 to 100) every month.

The service offers three plans, each of which includes:

- A package of cards (up to 100, renewed monthly),

- A top-up discount of up to 3% (more favorable than any other service we compared),

- And, as a sweet bonus, a 3% cashback.

The cost for any plan will be the same as card issuance on other services. Plus, you get the lowest crypto top-up fee and cashback from up to $100k.

Of course, the benefits will depend directly on a number of conditions, but we have tried to account for all of them in the comparison table. You can play with the numbers yourself, and below, we provide a detailed breakdown of all three subscription packages.

- With a $10k spend and 10 issued cards, ROI will increase by 14% compared to other services.

- With a $15k spend and 50 issued cards, ROI will increase by 18%.

- With a $100k spend and 100 issued cards, the ROI growth will be a whopping 19%.

All program participants will also have access to a familiar but important set of perks: teamwork functions, API access (otherwise you would have to pay $500 for it), and, of course, a Private manager.

If we consider extreme scenarios instead of average cases the results of fee optimization may be even more dramatic. Brocard doesn't forgive a high decline rate and charges $0.5 for each declined transaction. This fee alone can account for 5-10% of the advertising budget due to low advertising responsibility and an incorrect strategy.

Regarding other smaller services, it's essential not to forget about the risk of BIN (Bank Identification Number) attrition. In 2024, we've seen that only a few payment providers on the market don't face this issue.

In conclusion, PST.NET is our favorite in terms of fees, so let's delve into other significant aspects of their product.

2. Limits, BINs and Security

Alright, ROI’s growing yet what about the overall product features? Virtual payment services have various limitations, such as minimum top-up amounts, maximum transaction amounts, and spending limits over time. Let's take a closer look at what today's candidates have, and examine the pros and cons of each. We'll start with the downsides.

At PST.NET, unlike many affiliate payment providers, there is a KYC verification process. However, when we purchased the subscription, the verification was done automatically. It might be a temporary bug, or perhaps it's a hidden feature; we couldn't confirm for sure. Additionally, there is an additional $5 fee when topping up to $50. The support team informed us that this is due to transaction fees for small crypto amounts.

Furthermore, users are provided with a list of prohibited MCC (Merchant Category Code) categories, such as financial products and services, that the service's virtual cards cannot be used. Also, currently, only cards in dollars are available.

For other services, there is typically no verification process, and it is usually replaced by a technologically simpler interview or monthly spend confirmation. Almost all of them offer some form of 2FA, either through Google Authenticator or their own Telegram bot. Now, let's move on to BINs (Bank Identification Numbers), as the usage variability of cards makes the situation a bit more interesting.

These are the first 6 (or 8) digits in a card number, often attributed with magical properties, from getting into Zuckerberg's personal whitelist to being permanently banned on Google. Unfortunately, you can't know in advance how a particular BIN will work in combination with the rest of your setup. But the more BINs a payment provider has, and the more frequently new ones are added, the better. More BINs mean more opportunities for experiments and tests.

| Flexcard | Mybrocard | PST.NET | Spendge | 4×4 | |

|---|---|---|---|---|---|

| How many BIN | 8 | 23 | 25 | 5 | 2 |

| When was the last update | Several months ago | September 2023 | July 2023 | Couldn’t identify (long ago) | Couldn’t identify (long ago) |

Many services are expanding beyond just offering cards for advertising platforms and are providing customers with tools for payment of a “Basic Affiliate Kit,” including proxies, design service subscriptions, neural networks, VPS, and more. However, the use cases for these cards, even those that support 3Ds, often remain within the realm of marketing. But not for everyone. If PST.NET restricts certain MCCs, other services more often provide lists of permitted ones. Surprisingly, it turns out that the only licensed product on the market offers not only specialized cards for affiliate marketing but also for everyday expenses.

A few words about the number of BINs. Most services have product lines that don't exceed a dozen positions, but PST.NET offers users a whopping 25 BINs. Three of them have 3Ds, two operate in automatic mode and are categorized under “for TikTok.” The 3Ds codes for the third category are available in the interface, on Telegram, and via email. The service last updated its product line in July 2023, and at that time, it removed several Euro BINs. The PST BIN checker Pulse allows users to check the Decline Rate themselves.

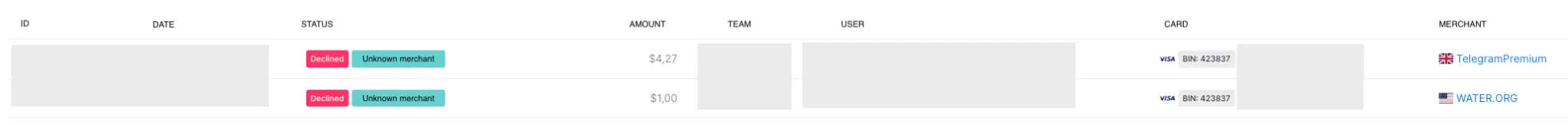

MyBroCard offers both cards for service payments and specialized ones for advertising, and BINs and cards are not separated by platforms. They have a total of 23 cards, all in dollars, and some have 3D enabled. However, it's mostly in auto-mode: the card will pass verification through AWS, but you won't be asked for a code. New positions are added regularly, with the latest one released just a few days ago. They don't advertise restrictions on merchants, but they are certainly present: some payments are declined due to “Unknown Merchant,” even though there is a balance on the card.

Summing Up on the Use of Virtual Cards for Increased ROI

As we move towards the end of this article it is pretty sure, that the virtual card market in 2024 is evolving from being just tools for media buyers into a source of income from traffic. Overall, all services offer users cards, the trustworthiness of which is one of the affiliate myths. Only tests can show which cards will work best with your specific setup. Whether you leave cards as a tool consuming up to 13% of your advertising budget or increase profitability with its help is now up to you, dear readers.